Douglas County Nebraska Personal Property Tax Return . Currently accepting returns for tax year 2024. who must file a nebraska personal property return? Get started » learn more » processing. personal property return nebraska net book value. nebraska personal property return must be filed with the county assessor on or before may 1. Anyone who owns or holds any taxable, tangible business personal. a nebraska personal property tax return must be filed on or before may 1 by: valuation lookup & mapping homestead exemptions. douglas county business personal property return. Anyone who owns or holds any taxable, tangible. You must file a personal property return if you:

from www.formsbank.com

nebraska personal property return must be filed with the county assessor on or before may 1. You must file a personal property return if you: Anyone who owns or holds any taxable, tangible business personal. Anyone who owns or holds any taxable, tangible. Currently accepting returns for tax year 2024. valuation lookup & mapping homestead exemptions. Get started » learn more » processing. who must file a nebraska personal property return? douglas county business personal property return. personal property return nebraska net book value.

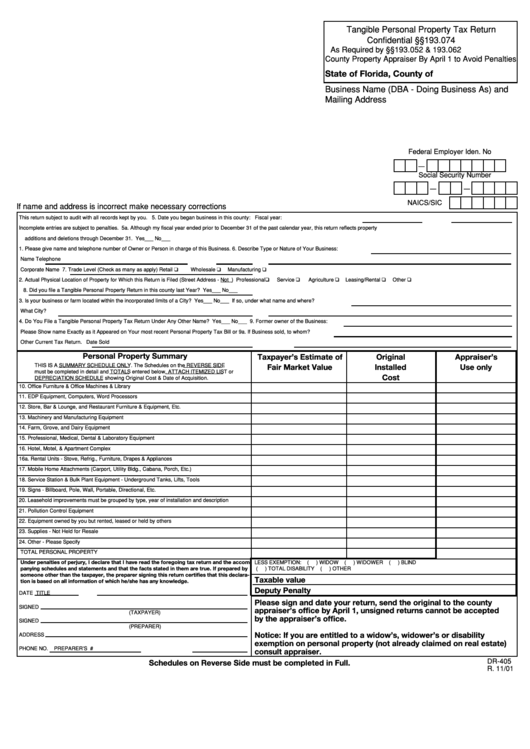

Form Dr405 Tangible Personal Property Tax Return 2001 printable pdf

Douglas County Nebraska Personal Property Tax Return Get started » learn more » processing. valuation lookup & mapping homestead exemptions. Currently accepting returns for tax year 2024. Anyone who owns or holds any taxable, tangible. nebraska personal property return must be filed with the county assessor on or before may 1. a nebraska personal property tax return must be filed on or before may 1 by: who must file a nebraska personal property return? douglas county business personal property return. Get started » learn more » processing. personal property return nebraska net book value. Anyone who owns or holds any taxable, tangible business personal. You must file a personal property return if you:

From www.douglas.co.us

2023 Property Tax Notifications arriving now Douglas County Douglas County Nebraska Personal Property Tax Return nebraska personal property return must be filed with the county assessor on or before may 1. Currently accepting returns for tax year 2024. personal property return nebraska net book value. Anyone who owns or holds any taxable, tangible business personal. You must file a personal property return if you: valuation lookup & mapping homestead exemptions. who. Douglas County Nebraska Personal Property Tax Return.

From www.wowt.com

Douglas County Treasurer slammed with property tax payments, lien bids Douglas County Nebraska Personal Property Tax Return Anyone who owns or holds any taxable, tangible business personal. a nebraska personal property tax return must be filed on or before may 1 by: douglas county business personal property return. who must file a nebraska personal property return? Get started » learn more » processing. personal property return nebraska net book value. Anyone who owns. Douglas County Nebraska Personal Property Tax Return.

From www.formsbank.com

Form Dr405 Tangible Personal Property Tax Return 2001 printable pdf Douglas County Nebraska Personal Property Tax Return who must file a nebraska personal property return? Anyone who owns or holds any taxable, tangible. Anyone who owns or holds any taxable, tangible business personal. valuation lookup & mapping homestead exemptions. Currently accepting returns for tax year 2024. You must file a personal property return if you: nebraska personal property return must be filed with the. Douglas County Nebraska Personal Property Tax Return.

From omaha.com

Tax values are up. Where are the biggest increases in Douglas and Sarpy Douglas County Nebraska Personal Property Tax Return douglas county business personal property return. Currently accepting returns for tax year 2024. Anyone who owns or holds any taxable, tangible business personal. Get started » learn more » processing. nebraska personal property return must be filed with the county assessor on or before may 1. You must file a personal property return if you: personal property. Douglas County Nebraska Personal Property Tax Return.

From revenue.nebraska.gov

Inheritance Tax Property Assessment Douglas County Nebraska Personal Property Tax Return douglas county business personal property return. who must file a nebraska personal property return? nebraska personal property return must be filed with the county assessor on or before may 1. Currently accepting returns for tax year 2024. Anyone who owns or holds any taxable, tangible. personal property return nebraska net book value. valuation lookup &. Douglas County Nebraska Personal Property Tax Return.

From topforeignstocks.com

Property Taxes by State Chart Douglas County Nebraska Personal Property Tax Return who must file a nebraska personal property return? personal property return nebraska net book value. douglas county business personal property return. nebraska personal property return must be filed with the county assessor on or before may 1. Get started » learn more » processing. Anyone who owns or holds any taxable, tangible business personal. Anyone who. Douglas County Nebraska Personal Property Tax Return.

From www.formsbank.com

Fillable Form Dr405 Tangible Personal Property Tax Return printable Douglas County Nebraska Personal Property Tax Return douglas county business personal property return. Currently accepting returns for tax year 2024. Anyone who owns or holds any taxable, tangible business personal. nebraska personal property return must be filed with the county assessor on or before may 1. who must file a nebraska personal property return? a nebraska personal property tax return must be filed. Douglas County Nebraska Personal Property Tax Return.

From douglascountyfairandrodeo.com

The countdown is on to the AwardWinning 2024 Douglas County Fair Douglas County Nebraska Personal Property Tax Return valuation lookup & mapping homestead exemptions. nebraska personal property return must be filed with the county assessor on or before may 1. Anyone who owns or holds any taxable, tangible. Anyone who owns or holds any taxable, tangible business personal. personal property return nebraska net book value. a nebraska personal property tax return must be filed. Douglas County Nebraska Personal Property Tax Return.

From www.wowt.com

Douglas County property owners upset over property tax cards error Douglas County Nebraska Personal Property Tax Return douglas county business personal property return. Currently accepting returns for tax year 2024. personal property return nebraska net book value. Anyone who owns or holds any taxable, tangible business personal. who must file a nebraska personal property return? Anyone who owns or holds any taxable, tangible. Get started » learn more » processing. valuation lookup &. Douglas County Nebraska Personal Property Tax Return.

From platteinstitute.org

Nebraska community college property tax repeal simplifying the tax Douglas County Nebraska Personal Property Tax Return a nebraska personal property tax return must be filed on or before may 1 by: who must file a nebraska personal property return? personal property return nebraska net book value. Anyone who owns or holds any taxable, tangible. Get started » learn more » processing. valuation lookup & mapping homestead exemptions. You must file a personal. Douglas County Nebraska Personal Property Tax Return.

From www.formsbank.com

Form Pr26 Personal Property Return 2010 printable pdf download Douglas County Nebraska Personal Property Tax Return douglas county business personal property return. nebraska personal property return must be filed with the county assessor on or before may 1. valuation lookup & mapping homestead exemptions. Anyone who owns or holds any taxable, tangible. personal property return nebraska net book value. You must file a personal property return if you: Anyone who owns or. Douglas County Nebraska Personal Property Tax Return.

From www.formsbank.com

Form Pt100 Business Personal Property Return printable pdf download Douglas County Nebraska Personal Property Tax Return personal property return nebraska net book value. douglas county business personal property return. You must file a personal property return if you: Currently accepting returns for tax year 2024. Anyone who owns or holds any taxable, tangible business personal. Get started » learn more » processing. a nebraska personal property tax return must be filed on or. Douglas County Nebraska Personal Property Tax Return.

From www.dochub.com

Where to get a personal property tax waiver Fill out & sign online Douglas County Nebraska Personal Property Tax Return Anyone who owns or holds any taxable, tangible. Currently accepting returns for tax year 2024. You must file a personal property return if you: nebraska personal property return must be filed with the county assessor on or before may 1. valuation lookup & mapping homestead exemptions. Anyone who owns or holds any taxable, tangible business personal. who. Douglas County Nebraska Personal Property Tax Return.

From www.templateroller.com

Form 4 Fill Out, Sign Online and Download Fillable PDF, Nebraska Douglas County Nebraska Personal Property Tax Return Anyone who owns or holds any taxable, tangible. nebraska personal property return must be filed with the county assessor on or before may 1. who must file a nebraska personal property return? Anyone who owns or holds any taxable, tangible business personal. douglas county business personal property return. Get started » learn more » processing. valuation. Douglas County Nebraska Personal Property Tax Return.

From answerschoolstrauss.z21.web.core.windows.net

Nebraska Inheritance Tax Return Douglas County Nebraska Personal Property Tax Return who must file a nebraska personal property return? personal property return nebraska net book value. valuation lookup & mapping homestead exemptions. nebraska personal property return must be filed with the county assessor on or before may 1. douglas county business personal property return. Anyone who owns or holds any taxable, tangible. Get started » learn. Douglas County Nebraska Personal Property Tax Return.

From www.pbctax.com

Tangible Personal Property Tax Application Constitutional Tax Collector Douglas County Nebraska Personal Property Tax Return Currently accepting returns for tax year 2024. personal property return nebraska net book value. You must file a personal property return if you: valuation lookup & mapping homestead exemptions. douglas county business personal property return. who must file a nebraska personal property return? Get started » learn more » processing. nebraska personal property return must. Douglas County Nebraska Personal Property Tax Return.

From www.formsbank.com

Form 2ta Business Return Of Tangible Personal Property And Machinery Douglas County Nebraska Personal Property Tax Return a nebraska personal property tax return must be filed on or before may 1 by: personal property return nebraska net book value. valuation lookup & mapping homestead exemptions. Anyone who owns or holds any taxable, tangible. who must file a nebraska personal property return? Get started » learn more » processing. You must file a personal. Douglas County Nebraska Personal Property Tax Return.

From www.dochub.com

Tangible personal property schedule Fill out & sign online DocHub Douglas County Nebraska Personal Property Tax Return Currently accepting returns for tax year 2024. Anyone who owns or holds any taxable, tangible business personal. Anyone who owns or holds any taxable, tangible. Get started » learn more » processing. nebraska personal property return must be filed with the county assessor on or before may 1. who must file a nebraska personal property return? You must. Douglas County Nebraska Personal Property Tax Return.